Change Browser!

Change Browser

Transformation Processes of the World Securities Market: Causes, Factors, and Consequences for the Republic of Belarus

The article examines the modern transformation processes of the world securities market, identifies the main periods of segmentation, analyzes the factors that contributed to the transformation processes at each of the periods. The modern tendencies are investigated, the peculiarities and distinctive features of the modern stage of development are revealed. The issue of the digitalization of securities markets is considered.

Keywords

securities market,

transformation,

financial markets,

factors,

digitalizationAuthors

| Lukyanin Aleksey D. | Belarus State Economic University | a.lukyanin@gmail.com |

Всего: 1

References

Мошенский С.З. Рынок ценных бумаг. Трансформационные процессы. М. : Экономика, 2010. 240 с.

World Bank open data. URL: http://data.worldbank.org/ (accessed: 02.17.2019).

International Monetary Fund data. URL: http://data.imf.org (accessed: 02.17.2019).

Neal L. The Rise of Financial Capitalism: International Capital Markets in the Age of Reason. Cambridge University Press, 1993. 294 p.

Lawson L., Snyder M., McWilliams D. Big Bang 20 years on. New challenges facing the financial services sector. London : Centre for policy studies, 2006. 88 p.

Kamal A.E.-W. The Development of Stock Markets: In Search of a Theory // The Development of Stock Markets: In Search of a Theory. 2013. Vol. 3, № 3. P. 606-624.

Hobijn B., Jovanovic B. The Information-Technology Revolution and the Stock Market: Evidence // American Economic Review. 2001. Vol. 91. P. 1203-1220.

Kavun S. Analysis of the Global Stock Market Trends // Journal of Finance and Economics. 2015. Vol. 3. P. 67-71.

Баранов В.М. Тенденции развития мирового финансового рынка // Молодой ученый. 2017. № 17 (151). C. 327-332.

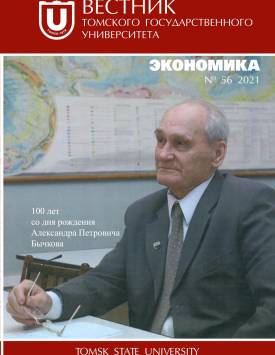

Transformation Processes of the World Securities Market: Causes, Factors, and Consequences for the Republic of Belarus | Vestnik Tomskogo gosudarstvennogo universiteta. Ekonomika – Tomsk State University Journal of Economics. 2021. № 56. DOI: 10.17223/19988648/56/14